Need to know the ins and outs of your payments and balances? Belvo has a solution for that.

Documentation Migration

We will migrate Belvo's Direct Debit Documentation to our dedicated DevPortal 27.01.2025. For more information, check: https://developers.belvo.com/docs/direct-debit-overview

Belvo's Payment Exports feature lets you extract information about your:

- Statements (for reconciliation)

- Payment Methods

- Payment Requests

In this guide we'll walk you through how to generate each type of report and explain what information you can extract from each one.

Statements

The Statements report is ideal for when you want to perform reconciliation with your data. The report will show you all the charge, fee, chargeback, and withdrawal movements that occurred in your Belvo account for a given period.

Glossary

A charge is when money was credited (deposited) into your Belvo account because of a successful withdrawal from your customer's account.

A fee is when money was debited from your account for processing a payment.

A chargeback is when a previously successful charge was challenged by your customer, and Belvo debited that amount from your account.

A withdrawal is when the balance of your Belvo account was transferred to your bank account.

Generating a statement report

To generate a report of all the movements in your Belvo account:

-

In your Direct Debit dashboard:

-

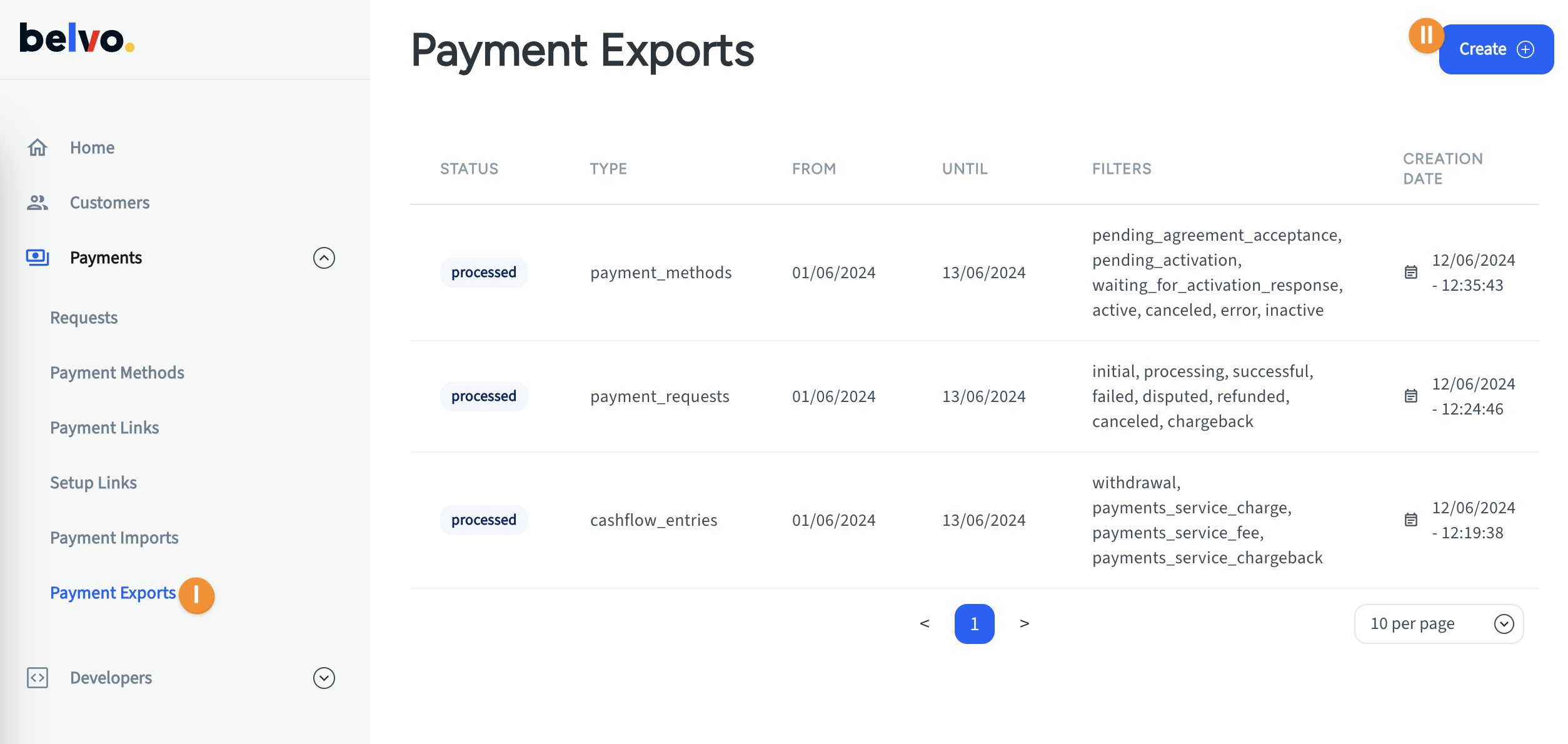

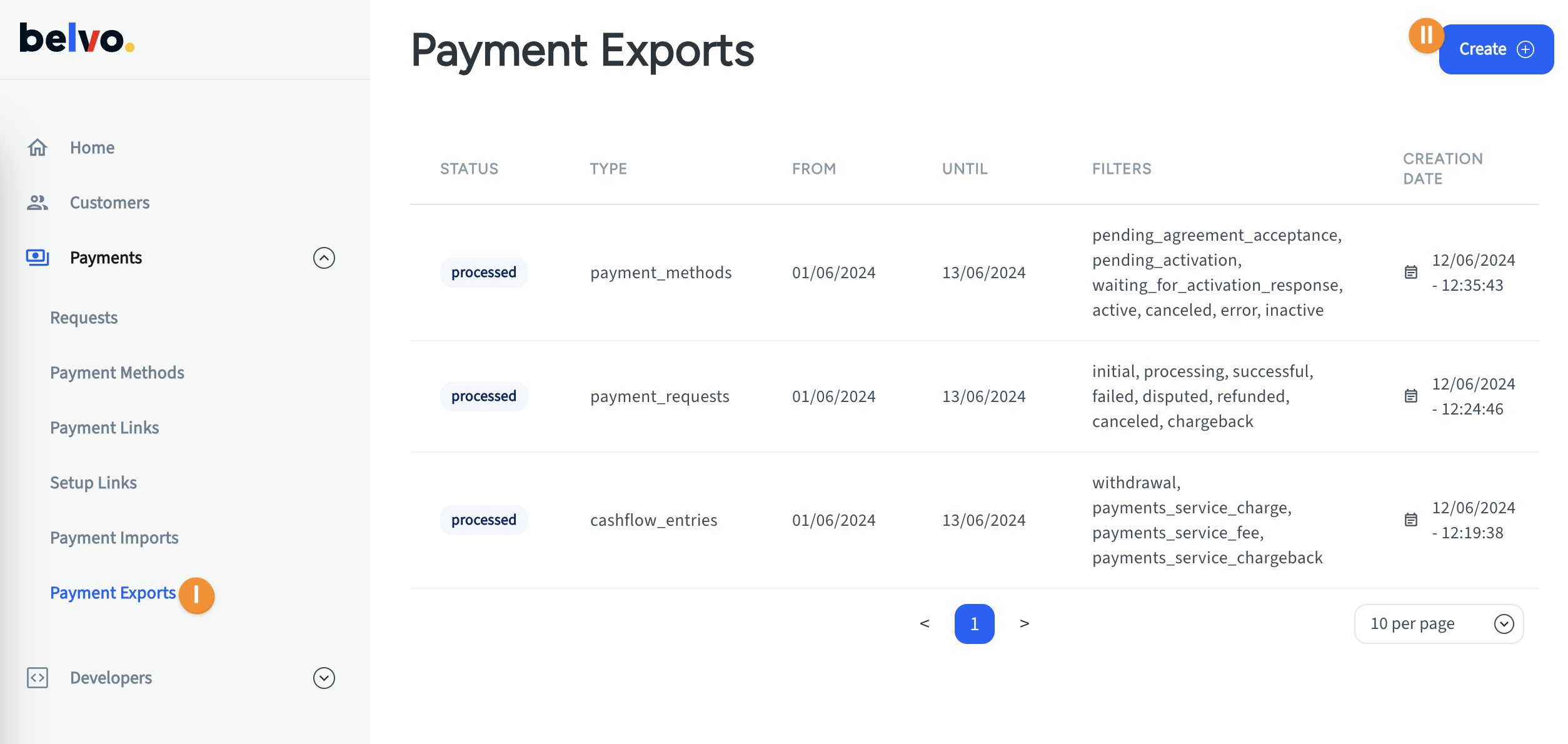

Go to Payment Exports.

-

Click Create.

-

-

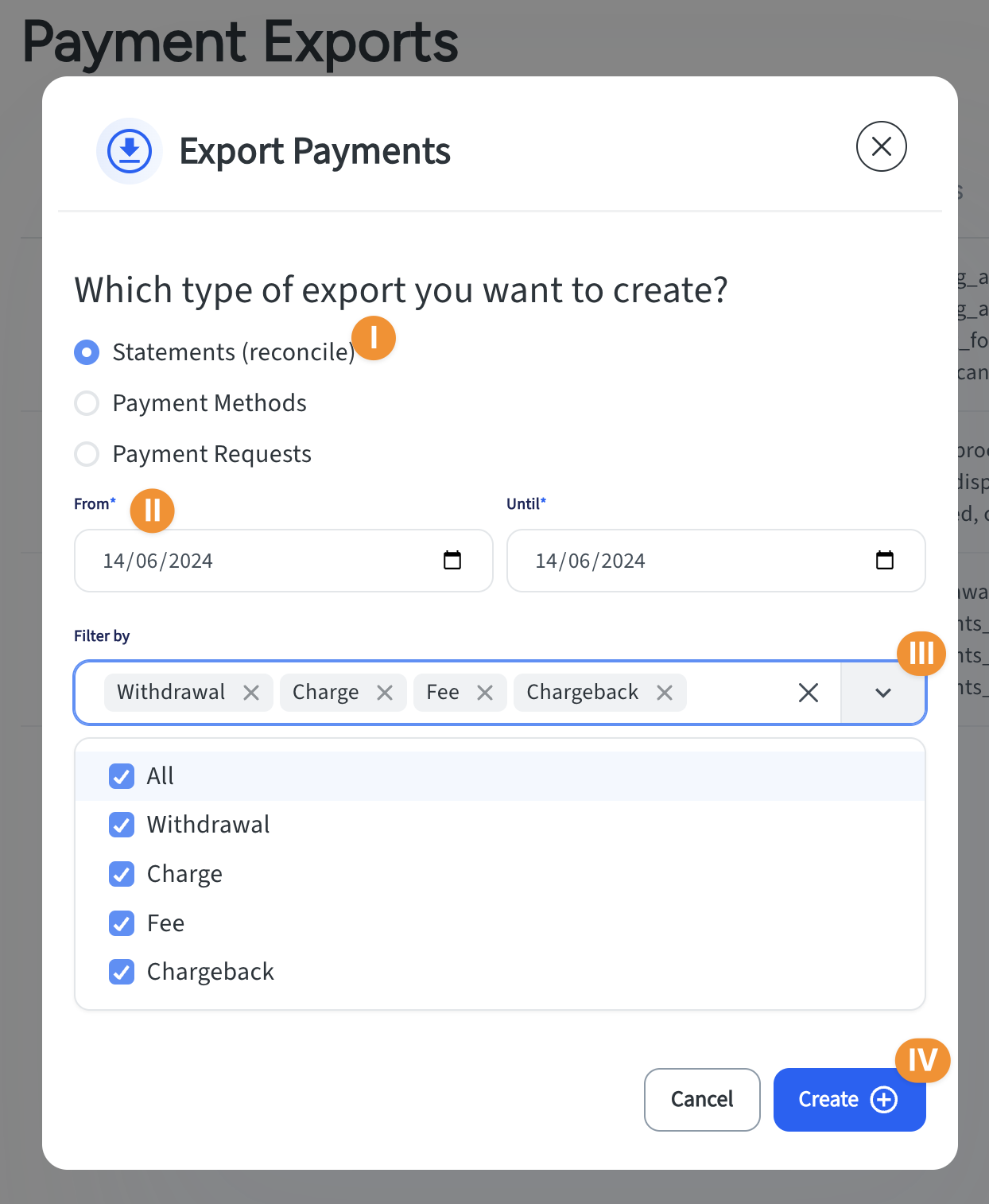

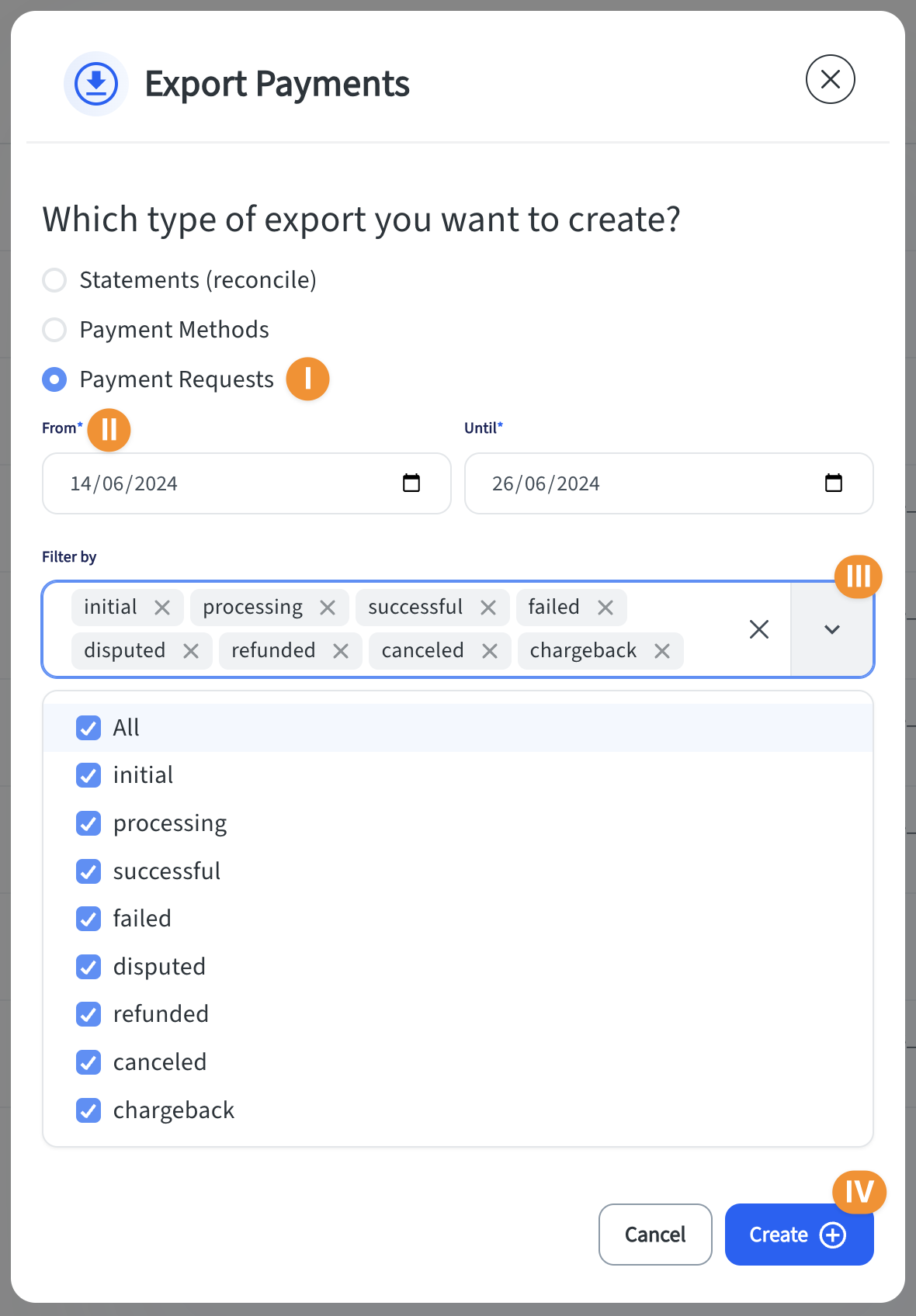

In the Export Payments pop-up:

- Select Statements (reconcile).

- Choose the date range for the report.

- Filter which movements you want to include (we recommend All).

- Click Create.

Done!

Your report will be generated within a few minutes. Once it is successfully generated, you will be able to download it using the Click to download button in the File column.

Report fields

The generated report will have the following columns, with reach row in the report being a separate movement:

| Statement Column | Description | Example |

|---|---|---|

| id | The unique ID of the movement. | 8e8954e6-c9cb-4ede-b163-2f392f041df6 |

| createdDate | The date that the movement occurred, in YYYY-MM-DD format. | 2024-05-03 |

| type | The type of movement. Can be either: - credit (money deposited into your account)- debit (money withdrawn from your account) | credit |

| reason | The reason for the movement type. Can be either:- charge (money was successfully retrieved from a user's account)- fee (the fee for processing the payment)- chargeback (a debit from your account due to a chargeback from your customer)- withdrawal (transfers from the Belvo account to your actual bank account) | charge |

| amount | The amount of the movement. | 270.00 |

| currency | The currency of the movement. | mxn |

| paymentRequestId | The ID of the associated payment request. | 37a2d810-8ecb-4111-acb2-c80c164ea789 |

| reference | Your internal reference fro the payment request. | J-7609S-776 |

| customerName | The name of your customer. | Juan Carlos Hernandez Garcia |

| customerDocumentType | The ID type of your customer. | mx_rfc |

| customerDocumentNumber | The ID number for the document type. | HEGJ820506M10 |

| paymentMethodType | The type of payment method. | bank_account |

| accountNumber | The account number of your customer. | 002665000000000001 |

Statement movements

A single payment request will have between two and three movements in a given statement. For example:

Successful (no chargeback) scenario

In the example excerpt below, where funds were successfully withdrawn from a customer's account and deposited into your Belvo account, you can see that there are two entries:

- A credit to your account (for the funds withdrawn from your customer's account).

- A debit from your account (the processing fee for the payment).

| id | createdDate | type | reason | amount | reference | paymentRequestId |

|---|---|---|---|---|---|---|

| 8f3d5cda... | 2024-05-03 | credit | charge | 320.00 | J-7609S-776 | 3baedc06... |

| 8851b7e0... | 2024-05-03 | debit | fee | 4.00 | J-7609S-776 | 3baedc06... |

Successful (with chargeback) scenario

In the example excerpt below, where funds were successfully withdrawn from a customer's account, deposited into your Belvo account, but withdrawn from your account due to your customer initiated a chargeback, you can see that there are three entries:

- A credit to your account (for the funds withdrawn from your customer's account).

- A debit from your account (the processing fee for the payment).

- A debit from your account due to a chargeback (for the amount of the initial charge)

| id | createdDate | type | reason | amount | reference | paymentRequestId |

|---|---|---|---|---|---|---|

| 8f3d5cda... | 2024-05-03 | credit | charge | 270.00 | J-8710T-887 | ad54dbb0... |

| 8851b7e0... | 2024-05-03 | debit | fee | 4.00 | J-8710T-887 | ad54dbb0... |

| 12a93426... | 2024-05-23 | debit | chargeback | 270.00 | J-8710T-887 | ad54dbb0... |

Payment Methods

Payment Method reports provide you with an an overview of all the bank accounts you have registered for your customers and their status, allowing you to get a quick overview of which payment methods are active, still pending to be confirmed, and failed.

Generating a payment method report

To generate a report of all the payment methods in your Belvo account:

-

In your Direct Debit dashboard:

-

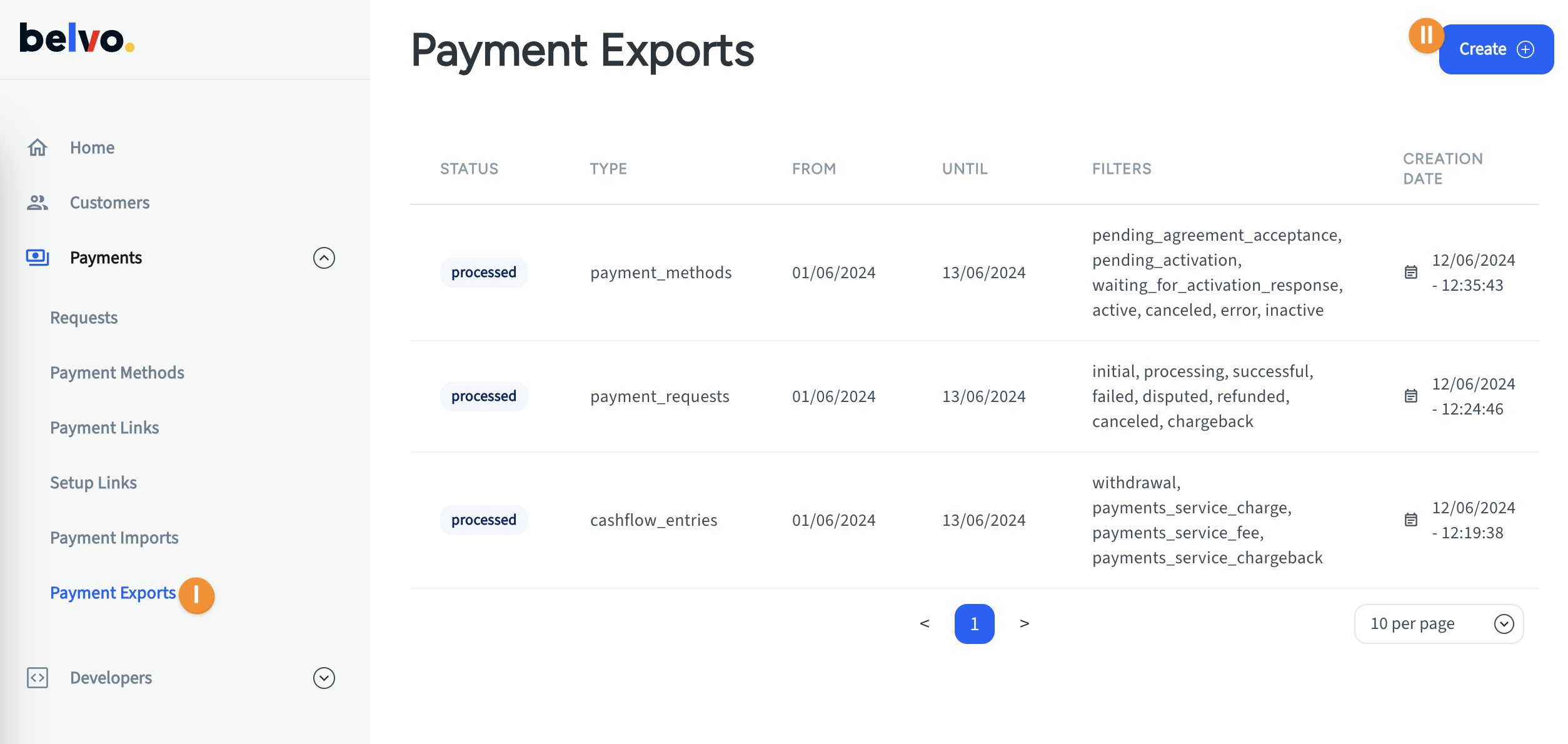

Go to Payment Exports.

-

Click Create.

-

-

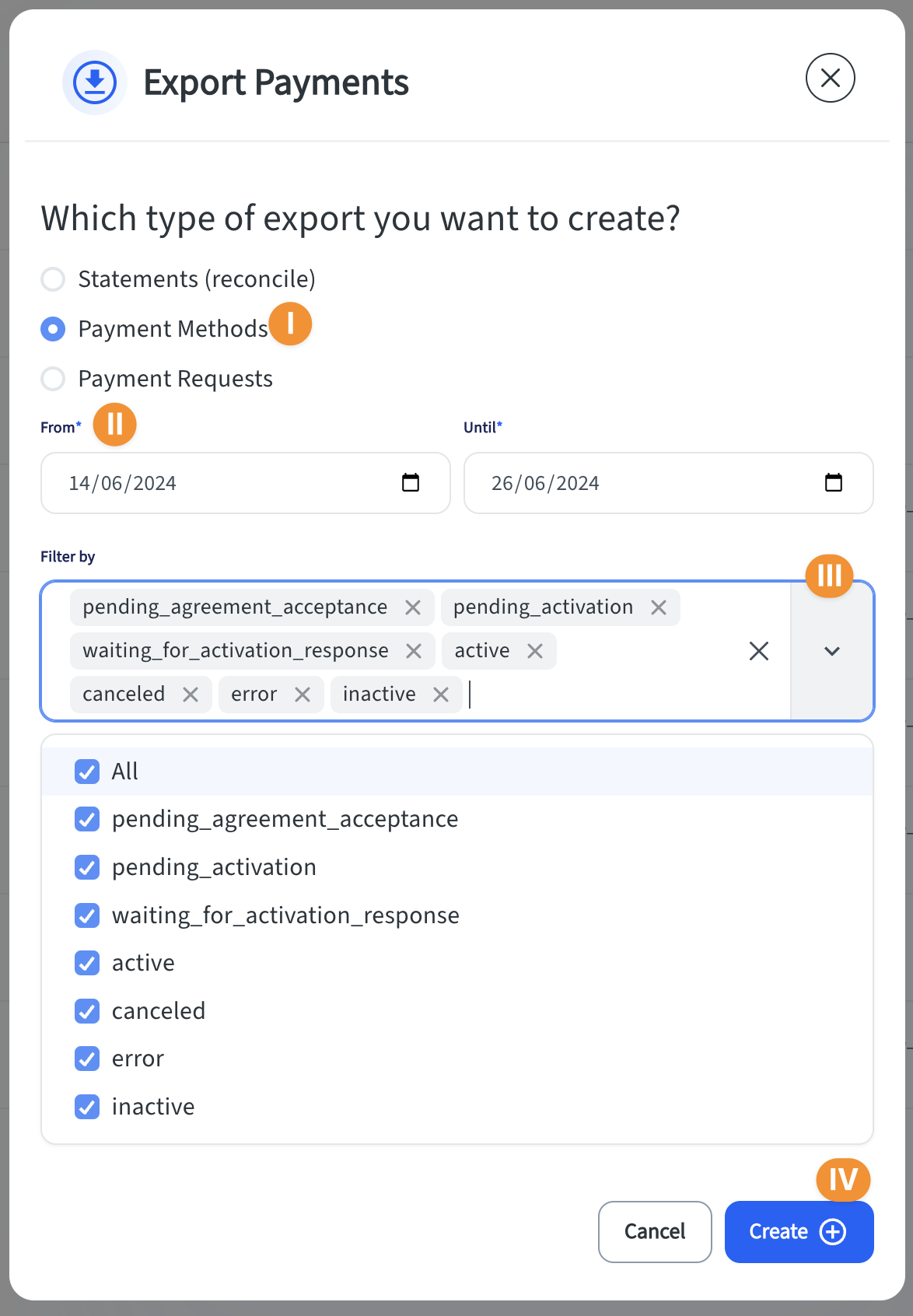

In the Export Payments pop-up:

- Select Payment Methods.

- Choose the date range for the report.

- Filter which statuses of your payment methods you want to include (we recommend All).

- Click Create.

Done!

Your report will be generated within a few minutes. Once it is successfully generated, you will be able to download it using the Click to download button in the File column.

Report fields

The generated report will have the following columns, with reach row in the report being a separate payment method:

| Payment Method Column | Description | Example |

|---|---|---|

| id | Belvo's unique ID for the payment method. | 4b14e571-89b0-4d80-838e-282ecc4fcfca |

| createdDate | The date that the payment method was created, in YYYY-MM-DD format. | 2024-06-05 |

| lastUpdatedDate | The date when the payment method was last updated (for example, a change in status), in YYYY-MM-DD format. | 2024-06-05 |

| customerDocumentType | The ID document type of the customer. | mx_rfc |

| customerDocumentNumber | The ID document number of the customer. | HEGJ820506M10 |

| accountBank | The institution where the account is held. | mx_citi_banamex |

| accountType | The type of account. | savings |

| accountNumber | The account number. | 002665000000000001 |

| reference | Your internal reference for the payment method. | |

| status | The status of the payment method. For details about about what statuses a payment request can have, see our dedicated article. | pending_activation |

| failedReason | If the payment method failed, the reason for the failure. For a full list of reasons that can be returned, see our dedicated errors article. | |

| failedMessage | If the payment method failed, the message explaining the failure. For a full list of messages that can be returned, see our dedicated errors article. |

Payment Requests

Payment Request reports provide you with an an overview of all the payment requests you have created for your customers and their status, allowing you to get a quick overview of which payment requests are active, still pending to be confirmed, and failed.

Payments Requests vs Statements

Payment Request reports only show the individual payment request changes for the time period. However, there can be situations where a payment request is successful, but within 90 days your customer initiates a chargeback, which will not appear on the initial report.

To see the complete movements that influence your balance, we highly recommend you use the Statements report.

Generating a payment request report

To generate a report of all the payment requests in your Belvo account:

-

In your Direct Debit dashboard:

-

Go to Payment Exports.

-

Click Create.

-

-

In the Export Payments pop-up:

- Select Payment Requests.

- Choose the date range for the report.

- Filter which statuses of your payment requests you want to include (we recommend All).

- Click Create.

Done!

Your report will be generated within a few minutes. Once it is successfully generated, you will be able to download it using the Click to download button in the File column.

Report fields

The generated report will have the following columns, with reach row in the report being a separate payment request status change:

| Payment Request Column | Description | Example |

|---|---|---|

| id | Belvo's unique ID for the payment request. | 017d5c0a-2aee-496f-b938-dcb848f7348b |

| createdDate | The date that the payment request was created, in YYYY-MM-DD format. | 2024-06-05 |

| lastUpdatedDate | The date when the payment request was last updated (for example, a change in status), in YYYY-MM-DD format. | 2024-06-05 |

| customerDocumentType | The ID document type of the customer. | mx_rfc |

| customerDocumentNumber | The ID document number of the customer. | HEGJ820506M10 |

| accountBank | The institution where the account is held. | mx_citi_banamex |

| accountType | The type of account. | savings |

| accountNumber | The account number. | 002665000000000001 |

| reference | Your internal reference for the payment request. | Shoe Payment |

| displayReference | The description that will show in your customer's banking platform when the payment is processed. | |

| amount | The amount for the payment request (in MXN) | 500 |

| status | The status of the payment request. For details about about what statuses a payment request can have, see our dedicated article. | initial |

| failedReason | If the payment request failed, the reason for the failure. For a full list of reasons that can be returned, see our dedicated errors article. | |

| failedMessage | If the payment request failed, the message explaining the failure. For a full list of messages that can be returned, see our dedicated errors article. |